Red Bull’s football empire is one of the most innovative and efficient talent production machines in modern football. Across Europe, South America, and North America, the Red Bull brand has reshaped how football clubs scout, develop, and maximize player potential. With clubs including RB Leipzig, Red Bull Salzburg, New York Red Bulls, and Red Bull Bragantino, the group has established a synchronized global network where talent flows seamlessly and value multiplies year after year.

At the heart of Red Bull’s success is a highly coordinated scouting model driven by a clear tactical identity, global intelligence sharing, early-market investment, and systematic player development. This is more than just good recruitment — it’s a football-industrial system with few rivals.

1. The Red Bull Philosophy: Identity-Driven Recruitment

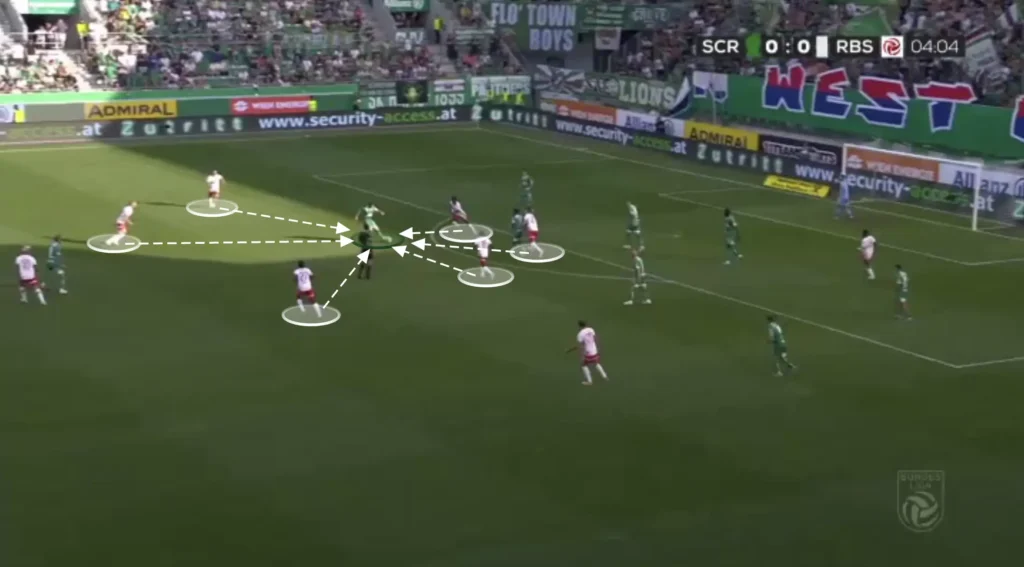

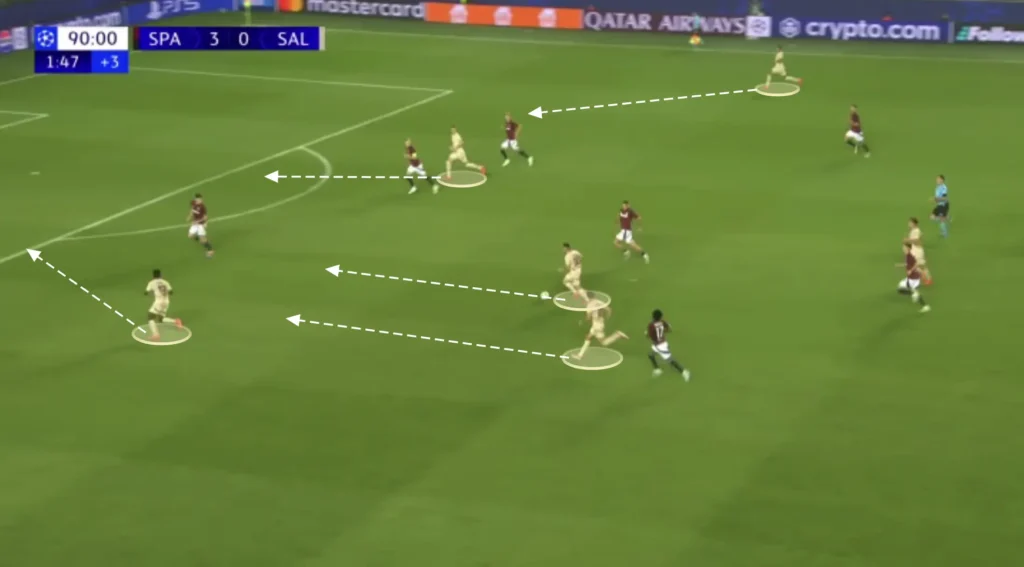

Red Bull clubs don’t build squads like traditional teams. Their recruitment doesn’t revolve around filling gaps or chasing market trends. Instead, they identify talent that fits a well-defined playing philosophy — aggressive, vertical, and relentlessly high-paced football.

This footballing identity stems from the ideas pioneered by Ralf Rangnick, who served as Head of Global Football at Red Bull and helped institutionalize a set of tactical and structural principles across the entire group. These principles include:

- High pressing and counter-pressing (Gegenpressing)

- Verticality and minimal horizontal passing

- Compact team structures in and out of possession

- Quick transitions and aggressive ball recoveries

- Attack through the center and half-spaces

Scouts are trained to identify players who can execute these principles under stress. Athleticism, decision speed, tactical discipline, and mental resilience matter more than raw technical flair. This isn’t to say Red Bull neglects technique — but they prioritize players who function optimally in their intense collective system.

2. Global Coordination: A Network, Not a Collection

What makes Red Bull’s model special is not just the clubs they own, but how they integrate them.

Each club operates semi-autonomously but within a central footballing framework. There’s a shared scouting database, standardized internal evaluations, and regular communication between sporting directors, head coaches, and analysts. The network includes:

- RB Leipzig (Germany) – Flagship club in Europe’s top 5 leagues

- Red Bull Salzburg (Austria) – The main development hub

- FC Liefering (Austria) – A feeder club owned and operated by Salzburg

- New York Red Bulls (USA) – Strategic access to North American market

- Red Bull Bragantino (Brazil) – South American base of talent and analytics

- RB Omiya Ardija (Japan) – Asian base of talent and analytics

- Red Bull Ghana (Academy, defunct but legacy continues)

- Scouting outposts in Africa, Eastern Europe, and Scandinavia

What sets this apart is the way talent flows strategically through the network. For example, Salzburg might sign a young Brazilian attacker who’s not ready for Leipzig. That player develops in Austria under similar tactical demands, gaining experience in European competition and domestic leagues. When ready, Leipzig signs him — no agent tug-of-war, no overpaying, no stylistic mismatch.

This seamless transition from one club to another isn’t accidental. It’s planned years in advance.

3. Talent Identification: What Red Bull Scouts Look For

Red Bull scouts are aligned on specific player traits. These traits go beyond technical ability — they reflect system fit and development potential.

Age Range:

- Typically 16–22

- Focused on players who can develop into elite contributors within 1–3 years

Athletic Profile:

- High acceleration and sprint speed

- Explosive power and recovery ability

- Capable of sustaining intensity for 90 minutes

- Low injury risk and good body control

Mental Attributes:

- Coachability

- Tactical discipline

- Quick decision-making under pressure

- Hunger to improve, willingness to adapt

Tactical Fit:

- Understands or can learn pressing triggers

- Maintains compact positioning in zonal structures

- Makes vertical movements off the ball

- Can handle the demands of high-frequency transitions

Position-Specific Profiles:

| Position | Key Attributes |

|---|---|

| Fullbacks | Overlapping runners, ball recovery, vertical passing, 1v1 defending |

| Center-backs | Mobile, anticipatory, good in duels, progressive passing over long and short distances |

| Midfielders | Two-way energy, defensive recoveries, vertical play, late runs into the box |

| Wingers | Direct dribbling, counter-attacking pace, inverted roles, high pressing work-rate |

| Strikers | Depth-runners, early shooters, press initiators, strong and explosive |

Red Bull isn’t afraid to take risks on raw players as long as their movement patterns and instincts match the system. Many of these players arrive from markets where traditional scouting attention is low, giving Red Bull a competitive edge.

4. Scouting Infrastructure: Data, Live Eyes, and Internal Feedback

The Red Bull group uses a hybrid scouting approach that combines advanced data analytics with traditional live scouting. They rely on data to filter talent pools — particularly physical output, pressing stats, and verticality — then use live scouting to assess contextual behaviors.

Key Scouting Metrics:

- High-speed distance covered (sprint volume per 90)

- PPDA (passes per defensive action)

- Duel success in transition zones

- Passes and carries into final third under pressure

- Pressing intensity zones (heat maps + GPS output)

- Recovery time after sprints

- Body orientation and reaction speed (from video tagging)

The in-person scouting process is extensive. Scouts attend youth internationals, domestic youth leagues, and obscure tournaments — often identifying players 12–24 months before major clubs take notice. Players are monitored over time, interviewed for mentality, and rated across Red Bull’s internal matrices.

Players are also “soft-tested” by inviting them to train or trial with the second teams (e.g. Liefering or RBNY II), where staff assess their fit before committing long-term.

5. Salzburg: The Development Factory

Red Bull Salzburg functions as the main incubator. Young talent gets minutes in the Austrian Bundesliga, which offers the right balance of physicality, pace, and room for mistakes. Players also gain exposure to the UEFA Champions League, where they’re tested against elite competition.

Below Salzburg, FC Liefering plays in Austria’s second tier and serves as a high-level development platform for younger players (often 16–19 years old). These players train under the same tactical conditions as Salzburg’s first team.

Key graduates from Salzburg/Liefering include:

- Erling Haaland – Developed for 12 months before exploding

- Benjamin Šeško – Signed at 16 from Slovenia, developed at Liefering

- Dominik Szoboszlai – Progressed from Liefering to Salzburg to Leipzig

- Karim Adeyemi – Signed from Unterhaching, developed into a national team player

Salzburg also benefits from its domestic dominance, which gives it the freedom to prioritize development over results — a luxury many clubs lack.

6. Strategic Transfers and Internal Promotions

Red Bull doesn’t just scout for the market — they scout with succession planning in mind. For every potential outgoing player, there’s already a replacement in development or in the scouting funnel.

When Dayot Upamecano was sold to Bayern Munich, Leipzig had Mohamed Simakan and Josko Gvardiol ready. When Naby Keïta moved to Liverpool, Konrad Laimer and Amadou Haidara were already in place.

This planning minimizes disruption and ensures performance continuity. The decision-making is centralized but efficient — player development, scouting, coaching, and board-level strategy are always aligned.

7. Global Market Penetration and First-Mover Advantage

Red Bull scouts aggressively in markets that are often underexploited:

- Eastern Europe – Especially Slovenia, Croatia, Hungary, and Serbia

- Scandinavia – Denmark, Norway, Sweden

- South America – Via Red Bull Bragantino, with a heavy focus on Brazil

- West Africa – Through partnerships, ex-academy ties, and local scouts

- USA/Canada – Through the New York Red Bulls and academy system

This wide coverage allows Red Bull to spot talent early and sign players before transfer values explode. They’re willing to take calculated risks — even signing players who are raw or inconsistent — because their development model can smooth out those rough edges.

Red Bull Bragantino also provides a major strategic edge. Competing in Brazil’s top tier, it gives Red Bull direct access to one of the world’s richest footballing talent pools.

8. A Proven Business Model

The Red Bull model isn’t just about performance — it’s also about value creation. Their transfer revenue is among the most efficient in Europe relative to net spend.

Notable Transfers:

| Player | Bought For | Sold For |

|---|---|---|

| Naby Keïta | €1.5M (Salzburg) | €60M (Liverpool) |

| Dayot Upamecano | €10M | €42.5M (Bayern) |

| Erling Haaland | ~€8M | €20M (Dortmund, + resale) |

| Dominik Szoboszlai | €500K | €36M (Leipzig to Liverpool) |

| Karim Adeyemi | €3.5M | €38M (Dortmund) |

| Benjamin Šeško | €2.5M | Internal to Leipzig → future big sale likely |

These profits are reinvested into infrastructure, analytics teams, youth academies, and staff. This creates a sustainable, repeatable model of competitive success.

Expanding the Periphery: Strategic Minority Investments

While Red Bull’s core football empire is built on full control of clubs like Salzburg, Leipzig, New York, Bragantino, Omiya Ardija, and Liefering, the company has also started planting flags in other markets through minority ownership stakes. These moves, though less publicized, are significant in understanding Red Bull’s broader ambitions.

In 2024, Red Bull entered into a partnership with Leeds United, becoming the club’s front-of-shirt sponsor for the 2024/25 season and acquiring an undisclosed minority stake. While this doesn’t place Leeds within the formal Red Bull football network, it does signal a calculated entry point into the English game — a market that had previously eluded the company due to regulatory and branding restrictions. There’s no evidence yet of shared sporting strategy, but the association gives Red Bull a presence in one of football’s most commercially powerful leagues.

A few months later, Red Bull acquired a 10.6% stake in Paris FC, a club in France’s Ligue 2(promoted to Ligue 1 this season). Red Bull’s involvement is relatively small in terms of control, but it offers a foothold in a major European capital with strong footballing roots and talent pipelines.

These minority stakes don’t currently feature the integrated recruitment, development, or playing model seen across Red Bull’s main clubs. However, they may be long-term plays — exploratory investments that keep doors open for deeper collaboration, future majority acquisitions, or simply brand presence in key footballing markets. At the very least, they offer a vantage point into leagues and player markets that Red Bull has traditionally scouted from a distance.

Conclusion: Why Red Bull’s Scouting Model Is a Benchmark

Red Bull’s network offers a glimpse into the future of football recruitment. Their success isn’t rooted in a single club, coach, or generation — it’s embedded in a system designed to outthink, outwork, and outdevelop the competition.

Where many clubs rely on reactive transfers, Red Bull operates with foresight. They identify young players who fit their footballing DNA, place them in the right club at the right time, and develop them for both performance and profit.

In an era where football gets more chaotic every season, Red Bull shows what’s possible when structure, identity, and scouting come together.